Is Buyer Demand Picking Back Up? What KC Sellers Should Know.

The Kansas City housing market hasn’t felt this energized in a long time—and the numbers backing that up are hard to ignore. Mortgage rates have eased significantly from their 2024 peaks, hovering now in the low 6% range. This shift is officially "waking up" the market as we head into 2026.

Home loan applications are rising, activity has picked up, and sellers who step in early could benefit from this momentum long before the spring competition catches on.

When Rates Come Down, Buyer Activity Goes Up

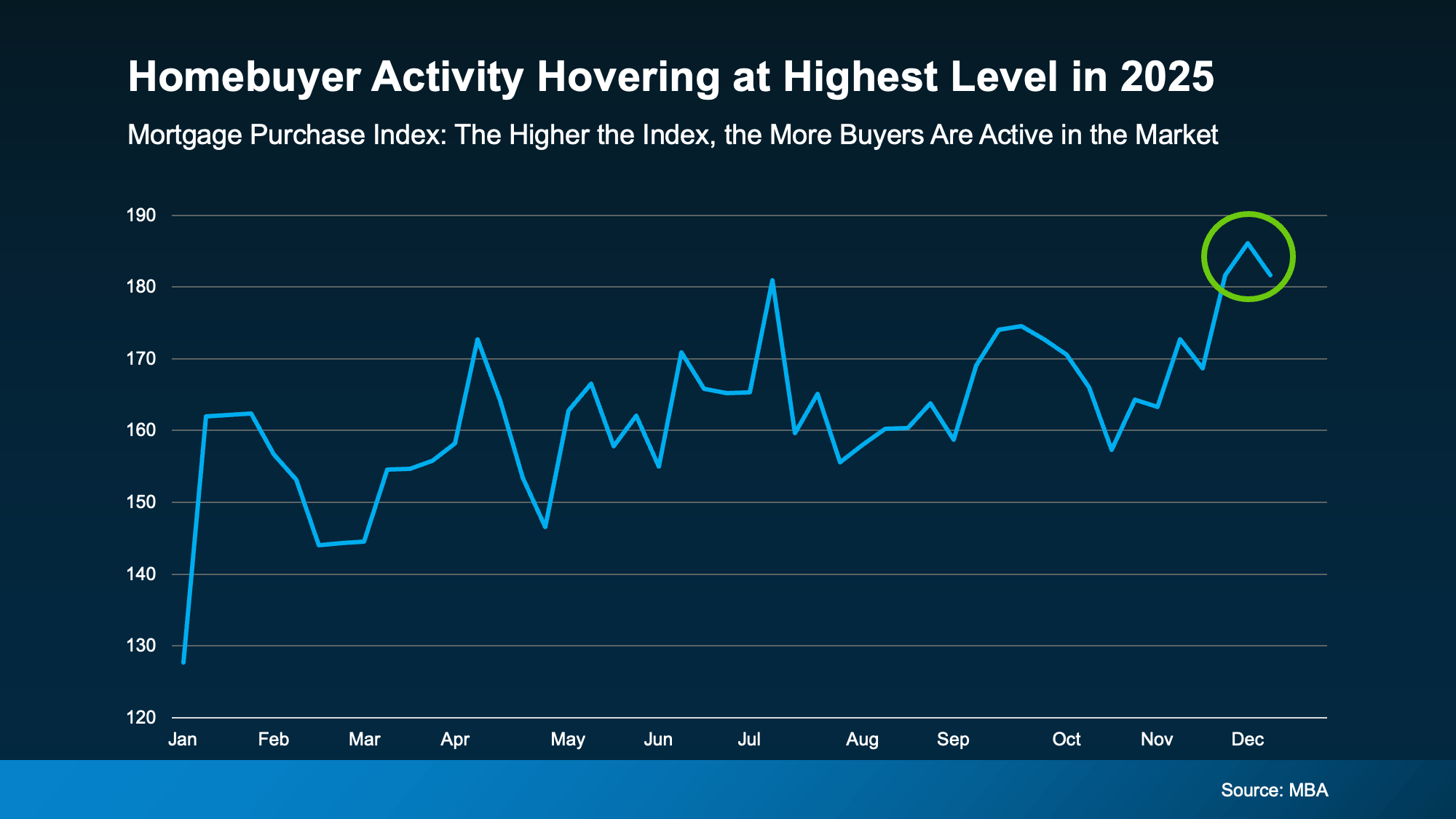

In today’s market, demand is closely tied to mortgage rates. Every time rates dip into the low-to-mid 6% range, we see an immediate influx of buyers. The data confirms this: the Mortgage Purchase Index is currently hovering at its highest level of the entire year.

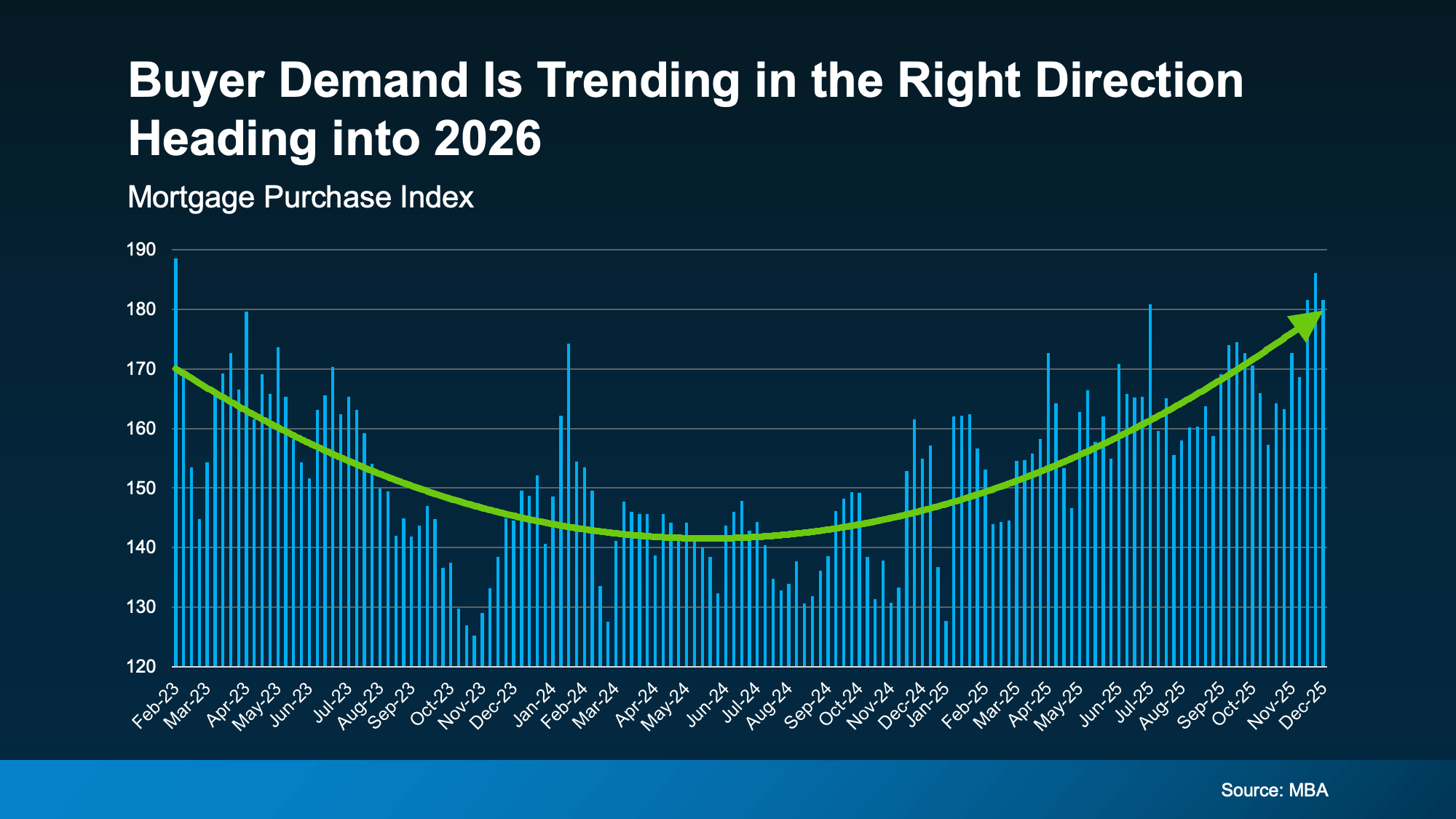

And that's not the only sign of optimism. MBA also shows mortgage applications recently hit their highest point in almost 3 years too. A clear sign demand is moving in the right direction heading into 2026:

This isn't just a temporary spike; it’s a steady build-up of momentum throughout 2025 that is now carrying us into 2026. Mortgage applications recently hit their highest point in almost three years, a clear sign that demand is moving in the right direction.

Home Sales Are Rebounding in the Metro

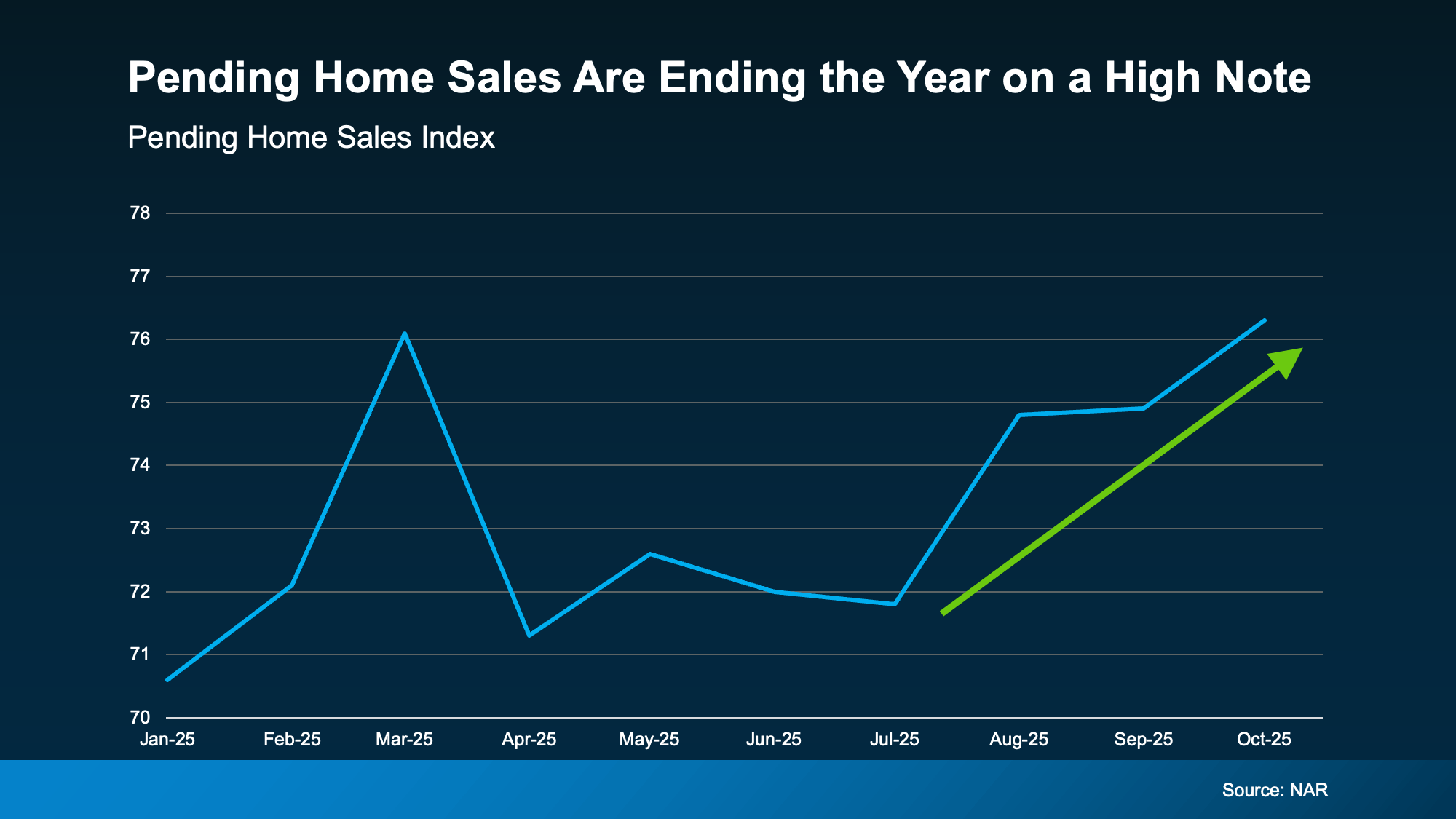

It’s not just applications—it’s actual contracts. The most recent report from the National Association of Realtors (NAR) shows that pending home sales are finishing the year on a high note.

Pending sales are a leading indicator of what will happen in the next 60 days. In Kansas City, we are already seeing this play out:

-

Johnson County: Median prices are up about 6% year-over-year to roughly $465,000.

-

Jackson County: Sales count is up around 6%, with a median price of $275,000.

-

Market Velocity: Well-priced homes in the metro are moving in an average of 30–45 days.

What This Means for You

If you’ve been waiting on the sidelines, here is why the current "Market Pulse" favors acting now:

-

More Motivated Buyer Traffic: Buyers who are re-engaging now feel they’ve already waited too long. If your house is priced and staged to "Concierge" standards, you can expect eager, high-quality traffic.

-

Ahead of the Curve: Listing in early 2026 puts you ahead of the traditional "Spring Rush" before other sellers realize the market has shifted.

-

Local Stability: While some national markets are cooling, Kansas City continues to outperform, maintaining steady appreciation and high demand.

Bottom Line

The stage is set for this momentum to continue. If you want to know how this activity specifically impacts your neighborhood—from Leawood to Liberty—let's talk.

I can provide a private consultation to review your home's value and help you decide if listing in early 2026 is the right strategic move for your goals.

Categories

- All Blogs (39)

- affordability (7)

- Buying Tips (12)

- Downsize (2)

- economy (7)

- equity (3)

- Expired/Withdrawn/Cancelled (2)

- First-Time Buyers (15)

- For Buyers (27)

- For Sellers (23)

- Forecasts (5)

- Home Prices (8)

- Inventory (6)

- Mortgage Rates (8)

- Move-Up (4)

- New Construction (3)

- Overpricing (1)

- Price it Right (1)

- Rent vs. Buy (2)

- Selling Tips (8)

Recent Posts

Founder & Principal | Munkel Real Estate Solutions | License ID: KS#00251082 | MO#2024042017

+1(913) 490-6011 | chris@munkelrealestatesolutions.com