Our Strategic Analysis: Three Steps to Clarity

We move beyond general headlines. Our strategic analysis blends macro data with local expertise, summarized below.

ANALYZE THE MACRO MARKET

We start with data on national rates, supply, and affordability shifts.

DEEP DIVE THE MICRO MARKET

We overlay proprietary local listing data, for the 8 core KC counties to assess local price momentum.

APPLY INSIGHTS TO YOUR HOME

We apply hyper-local data to your property for the most accurate and aggressive price strategy.

Munkel's Exclusive Briefing to the KC Metro Market: November 2025

For our clientele focused on high-value portfolio moves, velocity and insight are paramount. Munkel Real Estate Solutions presents a targeted analysis of the market, translating current data from the KC Metro, including Johnson, Leavenworth, and adjacent strategic hubs, into actionable home investment foresight.

The Munkel Thesis

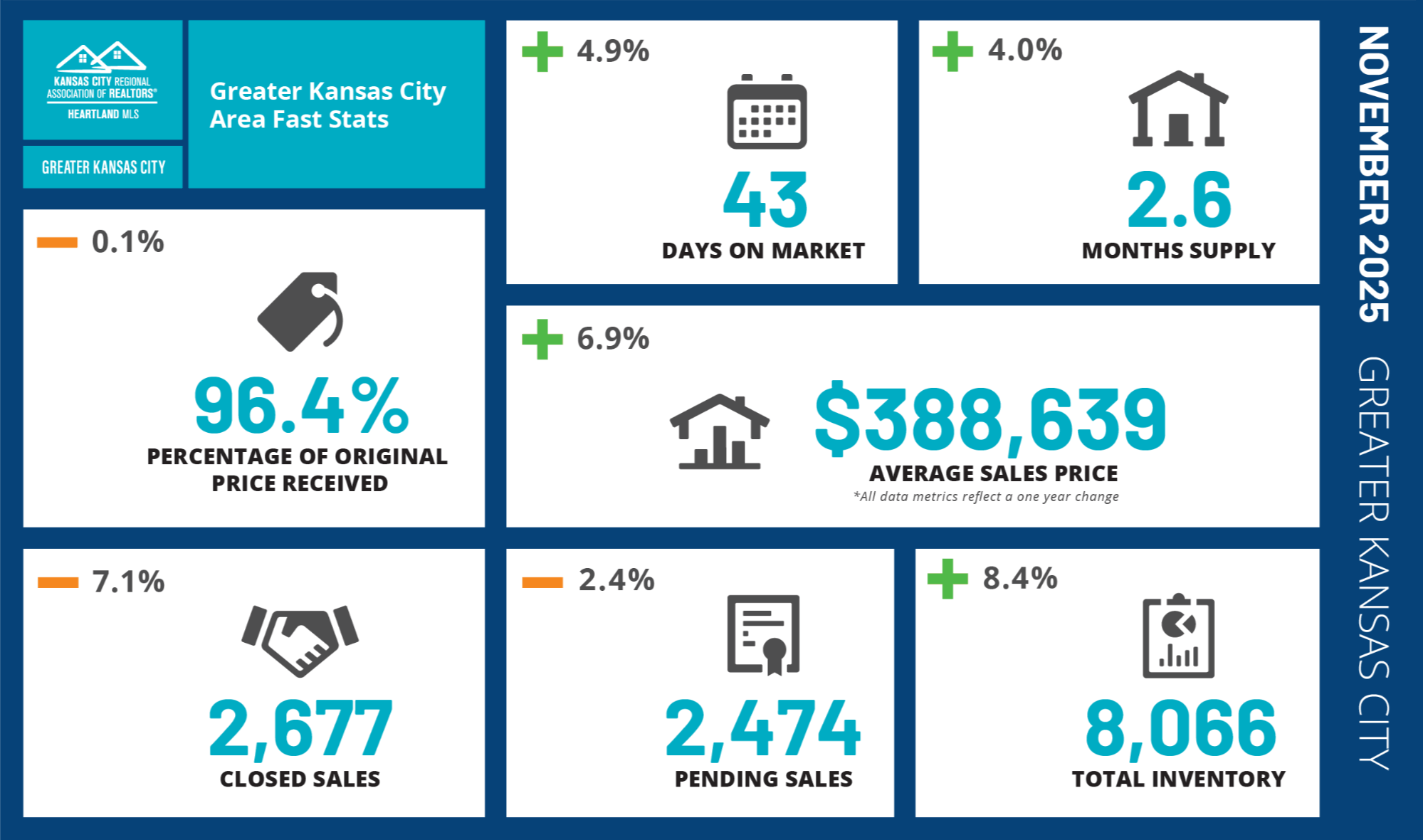

- Inventory Shift: Total Inventory saw a notable rise, up 8.4% Year-over-Year (YoY). This slight relief in supply creates a tactical window for discerning buyers in highly competitive segments like Leawood and Mission Hills to secure previously constrained inventory.

- Price Resilience: Despite slowing sales volume, the Average Sales Price remains exceptionally firm at $388,639. This confirms the sustained financial desirability and Authority of our high-net-worth properties, reflecting a 6.9% YoY appreciation.

- The Early 2026 Advantage: The Days on Market is competitive at 43 days. We advise owners in Loch Lloyd and key Leavenworth County districts to finalize their listing strategy now to capture the early surge of capital before the Spring Rush fully mobilizes.

- Market Fragmentation Confirms the Case for Hyper-Local Expertise

Metro-wide averages mask meaningful performance divergence at the county and sub-market level. November data shows continued pricing strength and liquidity concentration in Johnson County and select high-demand corridors, while peripheral markets exhibit rising inventory and elongated decision cycles. Interpreting these shifts correctly requires granular, boots-on-the-ground market fluency—not headline-driven analysis. - Pricing Power Remains Intact—But Only Where Strategy Aligns with Buyer Behavior

Despite moderation in overall transaction velocity, the data confirms that homes aligned with today’s buyer preferences—location quality, turnkey condition, and lifestyle efficiency—continue to secure strong terms. The market is not weakening uniformly; it is differentiating. Execution, positioning, and negotiation discipline now outweigh timing alone. - Current Conditions Favor Measured, Strategic Positioning Ahead of 2026 Momentum

November’s balance of modest inventory growth, stable pricing, and controlled days on market reflects a transitional phase rather than a correction. Historically, periods like this reward early, deliberate action—allowing sellers to avoid spring congestion and enabling buyers to negotiate from a position of clarity rather than urgency.

Christopher Munkel

Founder & Principal | Munkel Real Estate Solutions | License ID: KS#00251082 | MO#2024042017

+1(913) 490-6011 | chris@munkelrealestatesolutions.com