Headlines Have You Worried About Your Home’s Value? Read the KC Intel.

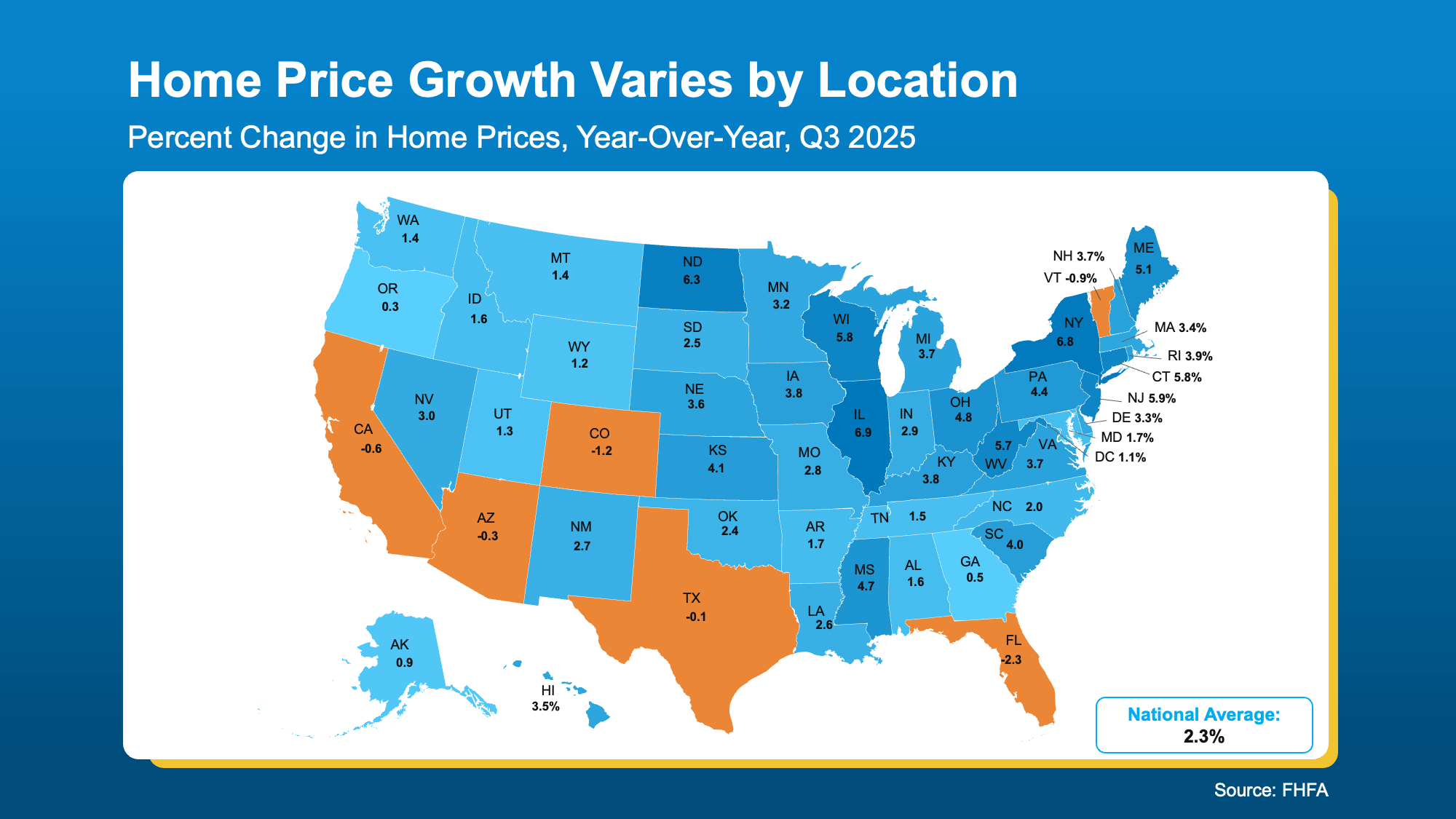

Hearing talk about home prices falling? If you’ve been scrolling through national news lately, you might be worried that your house is losing its hard-earned value. But here is the "Concierge" perspective: While some southern markets have seen minor corrections, home prices are not falling nationally—and they are certainly holding strong in Kansas City.

The vast majority of the country is still seeing prices rise, and the KC Metro is consistently outperforming the national curve.

The Data vs. The Drama

While headlines feed on negativity, the actual data from the Federal Housing Finance Agency (FHFA) tells a different story. In our region, the gains may not be as explosive as they were during the "frenzy" years, but they are steady and healthy.

Let’s break down what this really shows for us:

-

The "Blue" States: Most states (including Kansas at +4.1% and Missouri at +2.8%) are seeing prices rise, not fall.

-

National Rebound: Data from the National Association of Realtors (NAR) shows that nationally, home prices are up 2.1% compared to last year.

-

The "Orange" Correction: The small handful of states seeing dips (like Florida at -2.3%) are areas that spiked "too high, too fast" during the pandemic. What you are seeing there isn't a crash—it’s normalization.

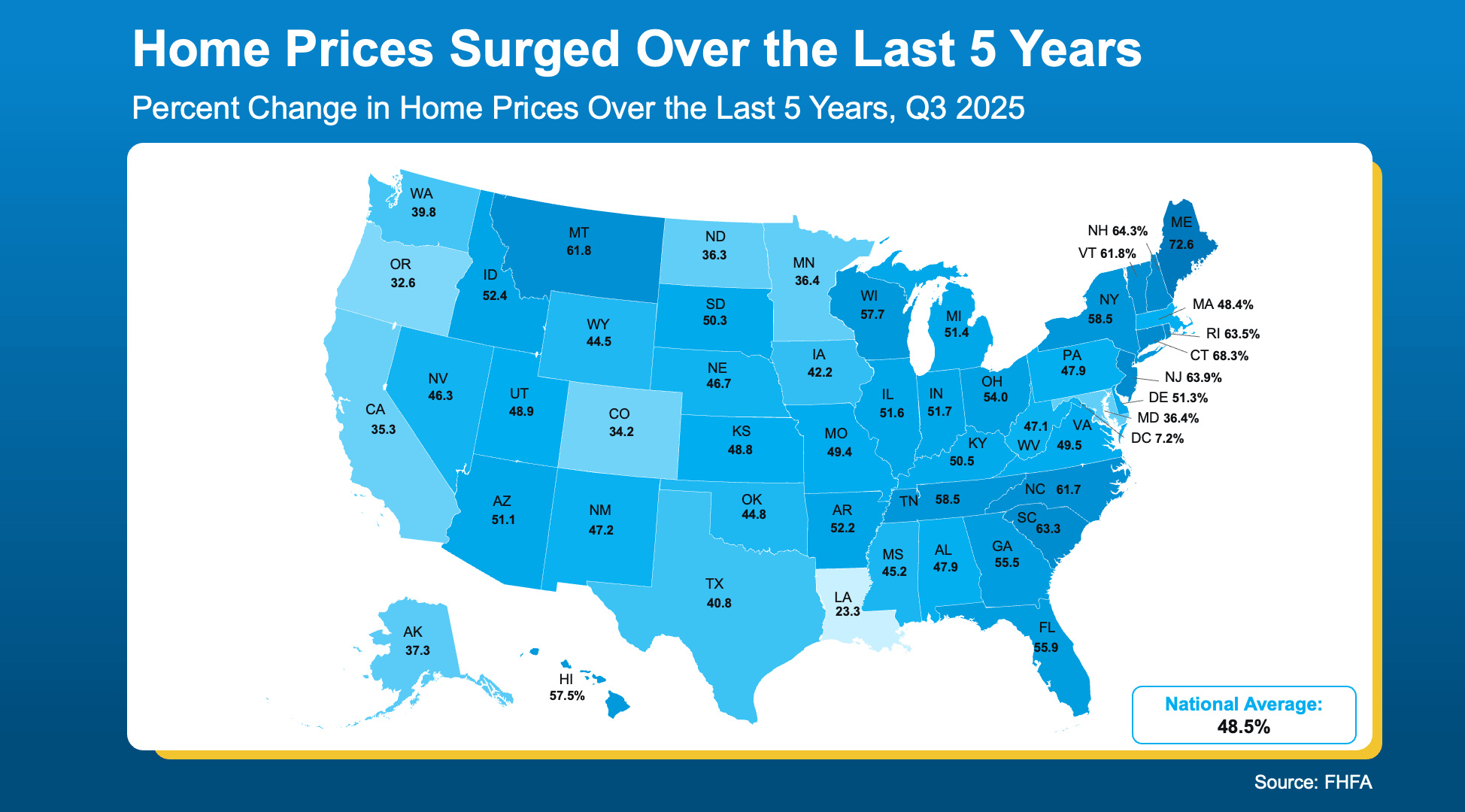

Most Homeowners Still Have Substantial Equity

Even in areas seeing a slight "softening," the long-term gains are massive. According to Zillow, only about 4% of homes are worth less than what the owner originally paid—meaning 96% of homeowners are still sitting on positive equity.

When you zoom out to the last five years, it becomes even clearer why Kansas City homeowners are in such great shape:

Nationally, prices have surged nearly 49% in the last five years. In our local submarkets, we've seen:

-

Johnson County: A median price of $475,000, up 4.4% year-over-year.

-

Overland Park: Reaching a $490,000 median as we head into early 2026.

-

Northland (Clay County): Rising 5.2% to a median of $347,000.

A minor 1% or 2% dip in some national markets is easily absorbed when you’ve gained 40% in value since 2020.

The Munkel Bottom Line

Don't let a generic headline determine your financial peace of mind. Real estate is local, and Kansas City is a market running on momentum. With 2026 predictions showing steady growth and inventory that is improving but still tight, your home’s value remains one of your most secure assets.

Want to know the specific value of your home in today's 2026 market? Let’s connect for a private "Market Activity" report tailored to your specific neighborhood—from Brookside to Blue Valley.

Categories

- All Blogs (39)

- affordability (7)

- Buying Tips (12)

- Downsize (2)

- economy (7)

- equity (3)

- Expired/Withdrawn/Cancelled (2)

- First-Time Buyers (15)

- For Buyers (27)

- For Sellers (23)

- Forecasts (5)

- Home Prices (8)

- Inventory (6)

- Mortgage Rates (8)

- Move-Up (4)

- New Construction (3)

- Overpricing (1)

- Price it Right (1)

- Rent vs. Buy (2)

- Selling Tips (8)

Recent Posts

Founder & Principal | Munkel Real Estate Solutions | License ID: KS#00251082 | MO#2024042017

+1(913) 490-6011 | chris@munkelrealestatesolutions.com