Our Strategic Analysis: Three Steps to Clarity

We move beyond general headlines. Our strategic analysis blends macro data with local expertise, summarized below.

ANALYZE THE MACRO MARKET

DEEP DIVE THE MICRO MARKET

We overlay proprietary local listing data, for the 8 core KC counties to assess local price momentum.

APPLY INSIGHTS TO YOUR HOME

We apply hyper-local data to your property for the most accurate and aggressive price strategy.

National Housing Brief

National housing data entering 2026 reflects a market that is stabilizing rather than accelerating. Price growth has moderated, inventory is rebuilding gradually, and affordability is expected to improve modestly as wage growth begins to outpace home price appreciation. Mortgage rates are forecast to decline slightly, but not enough to meaningfully reset demand on their own.

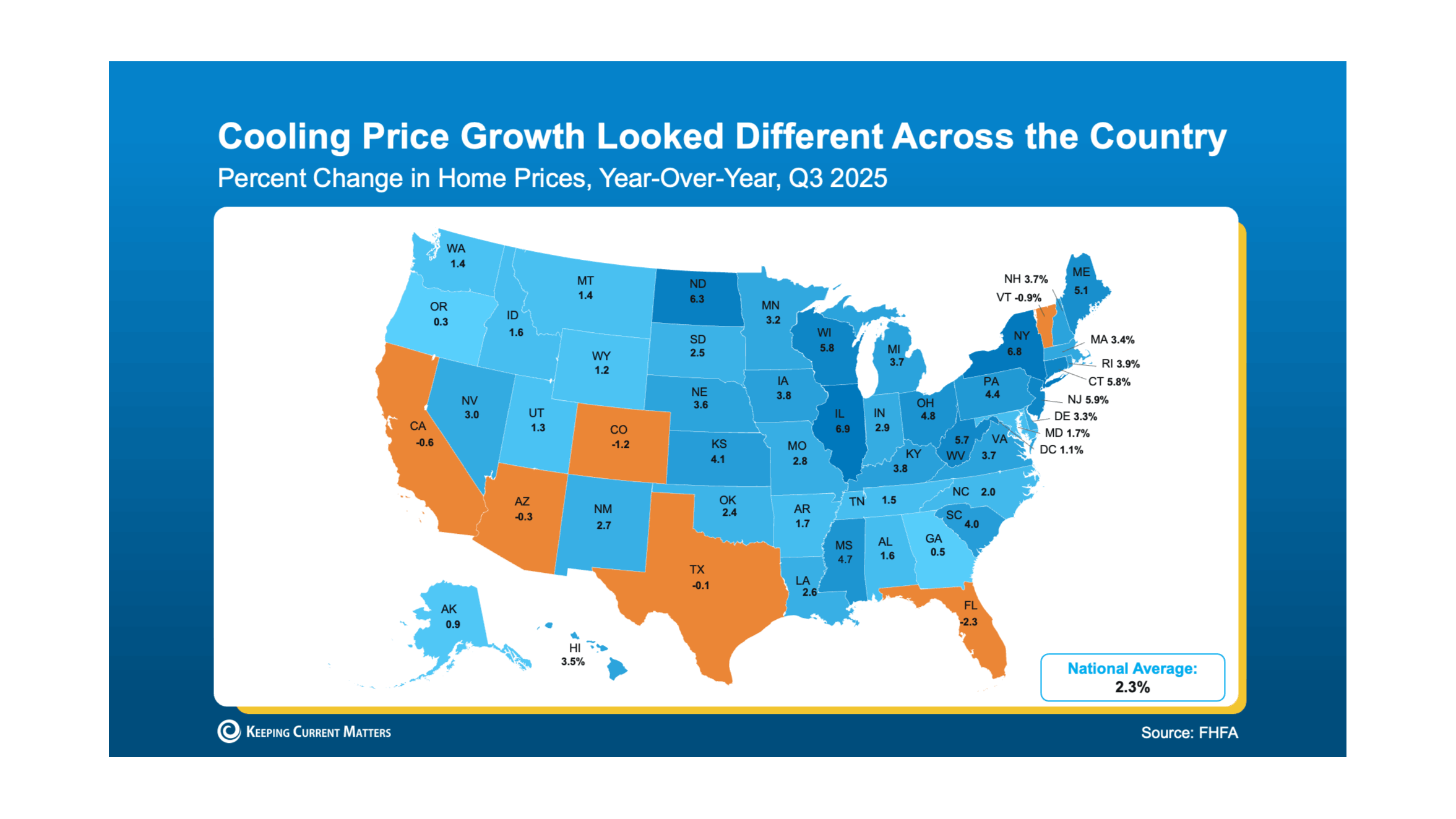

What national averages fail to capture is how unevenly these conditions are playing out. Recent data confirms that housing performance is increasingly regional, with tighter supply and stronger price resilience in parts of the Midwest and Northeast, while other regions experience softer conditions. This divergence reinforces a core reality of today’s market: headlines explain the environment, but outcomes are determined locally.

The purpose of this national context is not prediction. It is orientation. These forces create the boundaries within which metro and county markets operate—but they do not dictate results. As multiple economists note, 2026 is shaping up to be one of the most geographically divided housing markets in years, rewarding buyers and sellers who understand local structure, alignment, and positioning rather than relying on national sentiment alone.

Munkel's Exclusive Briefing to the KC Metro Market: December 2025

The Munkel Thesis

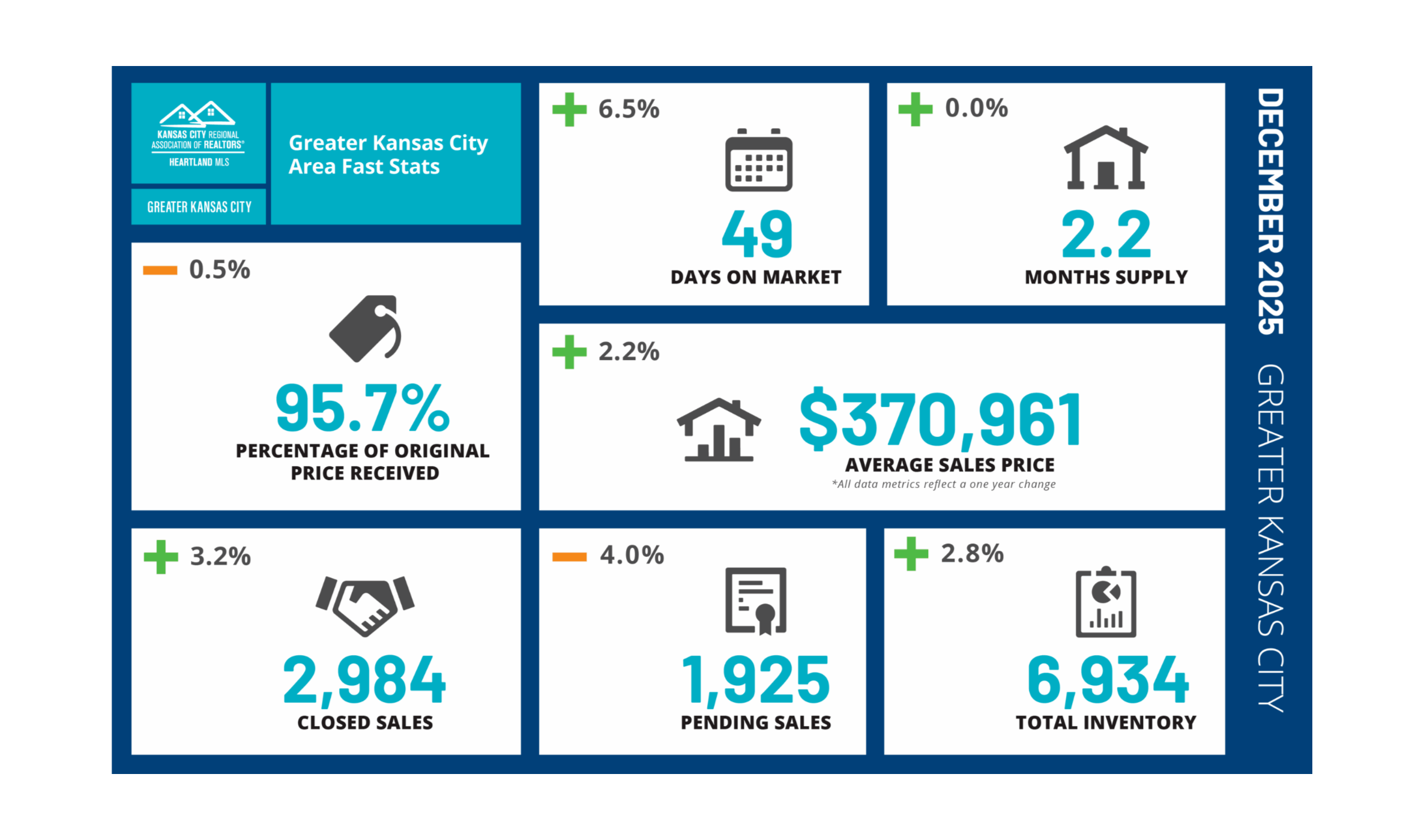

Inventory Stabilization: Total Metro Inventory concluded the year at 6,934 units, a modest 2.8% year-over-year increase. While this indicates a rebuilding phase, supply remains lean at 2.2 months, maintaining a tactical advantage for sellers of premium assets.

Price Appreciation & Resilience: The Average Sales Price across the Heartland MLS finished at $370,961. This represents a steady 2.2% year-over-year appreciation, confirming that despite seasonal cooling, equity in the Kansas City corridor remains exceptionally firm.

Closing Momentum: December outperformed expectations with 2,984 closed sales, a 3.2% increase compared to last year. This year-end surge suggests that capital is actively seeking placement ahead of projected 2026 shifts.

The Valuation Gap: The percentage of original list price received dipped slightly to 95.7%. This signals that "Price Strategy" is now the primary driver of liquidity; properties that are not aligned with micro-market demand face elongated decision cycles.

Market Differentiation & Strategy

Hyper-Local Divergence: Metro-wide averages continue to mask significant performance gaps at the county level. While core districts like Johnson County saw prices rise 5.2%, peripheral markets exhibited a more pronounced shift toward buyer leverage.

Execution Over Timing: With Days on Market rising to 49, the "Spring Rush" has already begun its mobilization phase. We advise our clients in high-demand sub-markets to finalize their positioning now to capture early-cycle demand before the primary inventory rebuild occurs in Q2.

Founder & Principal | Munkel Real Estate Solutions | License ID: KS#00251082 | MO#2024042017

+1(913) 490-6011 | chris@munkelrealestatesolutions.com